In the past three years, MotoGP has seen a variety of races and changes in team dynamics. This article provides a detailed analysis of the qualifying performances of MotoGP teams during this time. It aims to highlight their strategies and performance levels, and identify areas for improvement. The analysis will include pattern recognition, team comparisons, and an exploration of the factors that have influenced the current state of MotoGP.

Info: For this analysis I have calculated the average gap in terms of % to pole position for the fastest bike for each team. Only dry sessions data has been used to do the analysis

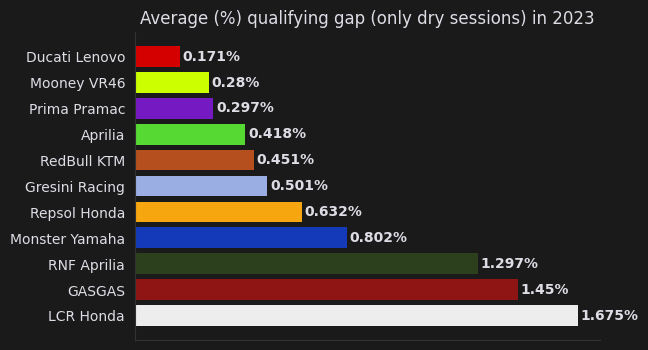

2023: Ducati is king

Starting by taking a look into the 2023 season which introduced sprint races, meaning that qualifyings took place in the saturday morning of each Grand Prix in stead of at lunch time as it had been the case for the time before.

Straight away looking at the top of the chart there are no surprises as the 3 fastest teams this season are Ducati teams. One interesting thing is that the Mooney VR46 team was actually faster than the Prima Pramac Racing despite their riders using the old GP22 in comparison with the new GP23 that Martin and Zarco used this year. Still, this is a very close top 3 (in fact, the closest in the last 3 years! Only 0.297%!)

Other worth noticing situations are Gresini being the worst Ducati team but still being only 0.5% off on average from pole, and even behind the official KTM team which has made a big step forward when comparing this season to 2022 and 2021 and are 0.45% off pole and very close to Aprilia.

In the bottom half of the graph we can find mainly japaneese constructors confirming their downfall since Quartararo’s title in 2021. Repsol Honda has pretty much stayed the most consistant through these 3 years being always mid-pack, but both LCR Honda (1.6% off pole!) and the official Yamaha (0.8% off pole) teams have experienced a noticeable decline over the past two years. The Tech3 (now GASGAS) and RNF teams both are suited to being bottom of the grpah as we will se in the next section.

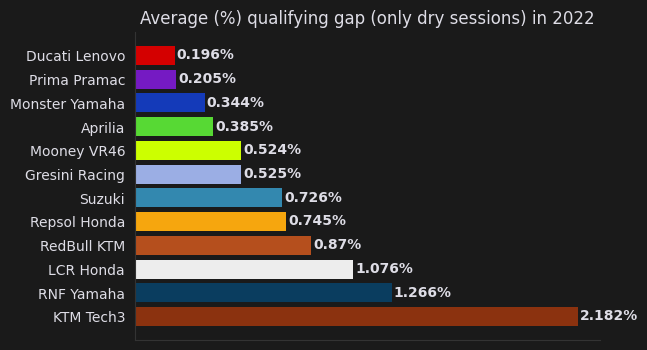

2022: Close calls everywhere

As depicted in the graph, the first to eighth teams exhibit a strikingly even distribution, forming pairs in a closely contested manner. The Ducati Lenovo team is closely matched with the Prima Pramac Racing, the Yamaha works team with Aprilia, and so forth. This balanced pairing among the top eight teams highlights the intense competition and tight qualifying throughout the season.

The 4 Ducati teams are still in the top 6, but the main surprise is just how competitive that Yamaha was (specially the first half of the season) in comparison to 2023 (from 0.3% off pole to 0.8%!). Also, this was the last season for Suzuki in MotoGP and it seems almost incredulous that they were so evenly matched with Honda on Saturdays. Because on Sundays, Suzuki managed to secure four podiums, including two victories in the last three races, while Honda continued to struggle, remaining elusive on race days.

The 2022 Aprilia was within less than 0.2% of the average pole position time of the Ducati GP22, highlighting its competitive performance. This sharp contrast becomes apparent when looking at the performance of the RNF Team in 2023, who, with the 2022 Aprilia, fell short by 0.7% compared to the Ducatis from 2022 under the VR46 team in the same season.

In the final third of the graphs are still the RNF Team and Tech3, (more than 2% off pole, tough days for Gardner and Fernendez) but what it’s more incredible: the works Red Bull KTM team, who went from being almost 0.9% off pole in average in 2022 to just 0.45%.

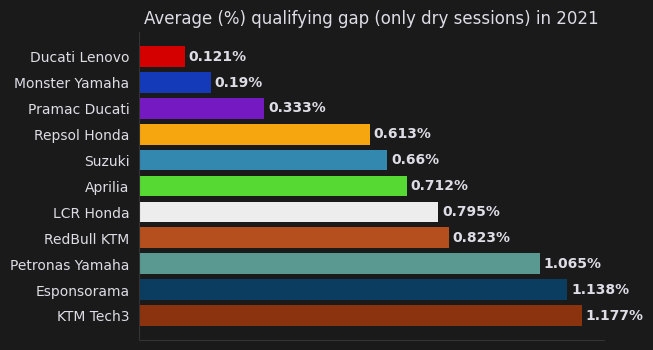

2021: Thight grid

As the title says and from what we can see in the graph, 2021 was the closest year in terms of distance to pole in the last 3 years, with the whole grid covered in only 1.1%! But here it can be aprecciated how MotoGP was not the Ducati cup so long ago, with 3 different japaneese manufacturers in the top 5. As I said earlier in the post, Honda has pretty much stayed between 0.6%-0.7% the last 3 years, and was still very close with Suzuki in 2021. But what strikes the msot is seeing Yamaha only 0.19% off pole in 2021 compared to the 0.8% from pole in 2023.

Aprilia started looking good in 2021, getting their first fron row in modern MotoGP in Germany, and their first podium in Silverstone. This was the last competitive year from LCR Honda on saturdays, being even faster than the official KTM team. Again the RNF (previously known as Petronas) and Tech3 were in the last third of the grid, but what strikes the most is seeing the Avintia/VR46/Esponsorama (it was a mess of names) team being the 2nd slowest with a Ducati, although it makes sense, as this team had a GP19 (2 year-old bike) to compete with.

Conclusion

In conclusion, as evident from these graphs, though already apparent to keen MotoGP followers, Ducati unequivocally asserts its dominance in the category. While it appears that Japanese manufacturers might be falling behind, Honda has maintained a relatively consistent gap with the fastest bikes over the past three years. Yamaha, on the other hand, has notably plateaued in performance, thus moving down the field. The challenge for Honda lies in Ducati’s strategic inclusion of more and higher-quality teams, who end up between the first and Honda positions, further hindering the Japanese constructor in each qualifying.

Moreover, there has been a significant leap forward for other European brands such as Aprilia and KTM, which have managed to halve their deficit to the pole within a span of two years. Although this analysis only covers performance of qualyfing, gives a more in depth look at how teams are progressing and how manufacturers can benefit or hinder themselves from having quality satelite teams.